Depreciation of fixed assets journal entry is Debit the Depreciation Account and Credit Corresponding Fixed Asset Account. Depreciation is the process of allocating the cost of a tangible fixed asset over its useful life. This process helps in matching the expense of using the asset with the revenue it generates. The journal entry for recording depreciation made at the end of each accounting period.

Below are some examples of journal entries related to the depreciation of fixed assets:

Example 1: Straight-Line Depreciation

Scenario: Your company purchased machinery for $50,000 on January 1, 2024. The machinery has a useful life of 10 years, and its salvage value at the end of its life is estimated to be $5,000. The annual depreciation expense would be calculated as follows:

Journal Entry:

| Date | Account Title | Debit ($) | Credit ($) |

|---|---|---|---|

| 12-31-2024 | Depreciation Expense | 4,500 | |

| 12-31-2024 | To Accumulated Depreciation – Machinery | 4,500 |

Explanation:

- Depreciation Expense will debited to reflect the cost of using the machinery for the year.

- Accumulated Depreciation – Machinery will credited to accumulate the total depreciation over the asset’s life.

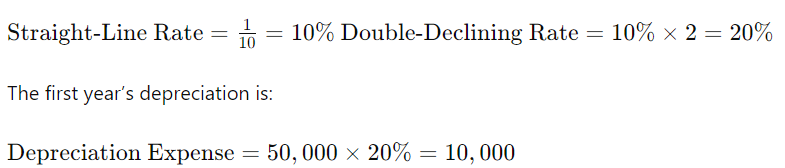

Example 2: Double-Declining Balance Depreciation

Scenario: Using the same machinery from Example 1, if your company chooses the double-declining balance method for depreciation, the calculation would be different. The double-declining balance rate is twice the straight-line rate, so:

Journal Entry:

| Date | Account Title | Debit ($) | Credit ($) |

|---|---|---|---|

| 12-31-2024 | Depreciation Expense | 10,000 | |

| 12-31-2024 | To Accumulated Depreciation – Machinery | 10,000 |

Explanation:

- Depreciation Expense will debited for the higher depreciation expense in the early years.

- Accumulated Depreciation – Machinery will credited to accumulate the depreciation.

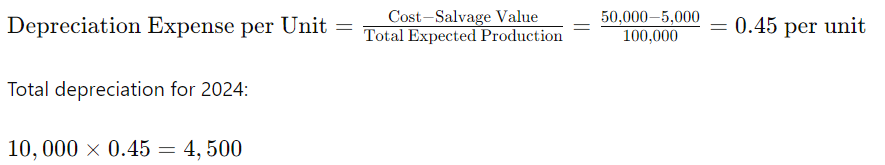

Example 3: Units of Production Depreciation

Scenario: Your company expects the machinery to produce 100,000 units over its life. In 2024, the machinery produces 10,000 units. The depreciation expense per unit is calculated as follows:

Journal Entry:

| Date | Account Title | Debit ($) | Credit ($) |

|---|---|---|---|

| 12-31-2024 | Depreciation Expense | 4,500 | |

| 12-31-2024 | To Accumulated Depreciation – Machinery | 4,500 |

Explanation:

- Depreciation Expense will debited based on the actual usage of the machinery.

- Accumulated Depreciation – Machinery will credited to accumulate depreciation based on production.

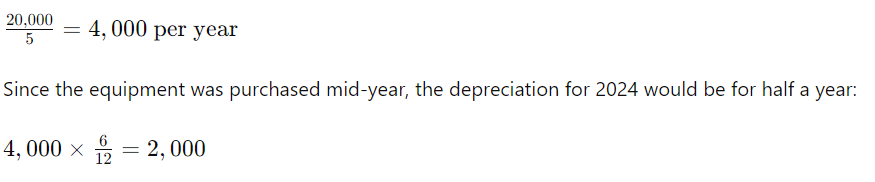

Example 4: Partial Year Depreciation

Scenario: Your company purchased equipment on July 1, 2024, for $20,000, with an expected life of 5 years and no salvage value. Using straight-line depreciation, the annual depreciation is:

Journal Entry:

| Date | Account Title | Debit ($) | Credit ($) |

|---|---|---|---|

| 12-31-2024 | Depreciation Expense | 2,000 | |

| 12-31-2024 | To Accumulated Depreciation – Equipment | 2,000 |

Explanation:

- Depreciation Expense will debited for the six months of depreciation.

- Accumulated Depreciation – Equipment will credited to accumulate depreciation for the partial year.

These examples illustrate different methods of recording depreciation for fixed assets, depending on the method and timing chosen by the company.